The Basic Principles Of Personal Loans Canada

The Basic Principles Of Personal Loans Canada

Blog Article

What Does Personal Loans Canada Do?

Table of ContentsThe 30-Second Trick For Personal Loans CanadaFascination About Personal Loans CanadaThe Definitive Guide to Personal Loans CanadaSome Ideas on Personal Loans Canada You Should KnowNot known Incorrect Statements About Personal Loans Canada

This implies you have actually provided every buck a task to do. putting you back in the vehicle driver's seat of your financeswhere you belong. Doing a regular budget will certainly provide you the confidence you need to handle your cash efficiently. Good ideas come to those that wait.However conserving up for the large things indicates you're not going right into debt for them. And you aren't paying extra over time due to all that passion. Count on us, you'll delight in that family cruise ship or playground collection for the youngsters way more recognizing it's currently spent for (rather than paying on them up until they're off to college).

Nothing beats satisfaction (without financial obligation naturally)! Financial debt is a trickster. It reels you in only to hold on for dear life like a crusty old barnacle. You don't have to transform to individual loans and financial debt when things obtain tight. There's a far better means! You can be without debt and begin materializing grip with your cash.

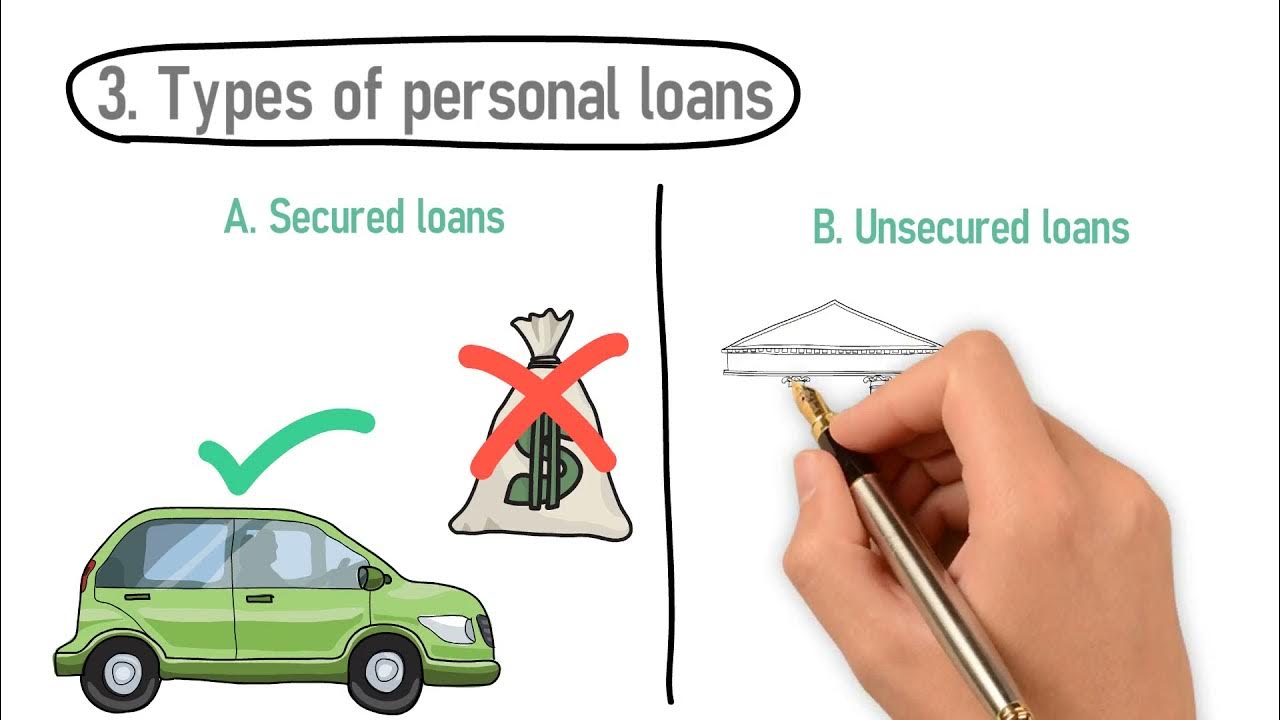

They can be protected (where you provide security) or unsecured. At Springtime Financial, you can be approved to obtain money approximately car loan quantities of $35,000. A personal finance is not a line of credit score, as in, it is not revolving funding (Personal Loans Canada). When you're approved for an individual car loan, your lending institution provides you the total all at as soon as and afterwards, usually, within a month, you begin settlement.

Getting The Personal Loans Canada To Work

Some banks placed stipulations on what you can use the funds for, but numerous do not (they'll still ask on the application).

The need for personal finances is climbing amongst Canadians interested in leaving the cycle of cash advance financings, combining their debt, and restoring their debt rating. If you're using for a personal lending, right here are some things you need to maintain in mind.

More About Personal Loans Canada

In addition, you may be able to minimize just how much complete interest you pay, which implies even more cash can be saved. Individual finances are effective devices for developing your credit rating. Settlement history make up 35% of your credit rating, so the longer you make normal repayments promptly the a lot more you will see your rating increase.

Personal car loans supply a terrific possibility for you to reconstruct your credit rating and settle financial obligation, but if you do not budget plan properly, you might dig on your own into an even much deeper opening. Missing one of your regular monthly payments can have an adverse impact on your credit report yet missing numerous can be ruining.

Be prepared to make each and every single payment promptly. It holds true that an individual financing can be made use of for anything and it's easier to get approved than it ever before was in the past. Yet if you do not have an urgent demand the additional cash, it might not be the very best solution for you.

The dealt with regular monthly repayment quantity on an individual funding depends upon just how much you're obtaining, the rates of interest, and the set term. Personal Loans Canada. Your rates of interest will depend on aspects like your credit history and look at this website revenue. Many times, individual lending prices are a whole lot lower than credit report cards, but occasionally they can be higher

The Ultimate Guide To Personal Loans Canada

Perks consist of excellent rate of interest prices, unbelievably quick handling and funding times & the anonymity you may desire. Not everyone likes strolling into a bank to ask for cash, so if this is a difficult place for you, or you simply don't have time, looking at on-line lenders like Spring is a great choice.

That mostly depends upon your ability to repay the quantity & pros and disadvantages exist for both. Repayment sizes for personal car loans generally fall within Read Full Report 9, 12, 24, 36, 48, or 60 months. Sometimes longer settlement periods are an option, though unusual. Shorter settlement times have very high monthly settlements yet then it's over promptly and you do not lose even more cash to interest.

The Single Strategy To Use For Personal Loans Canada

You might obtain a lower interest price if you finance the finance over a shorter duration. An individual term financing comes with a concurred upon settlement routine and a fixed or drifting passion rate.

Report this page